Tax Rates

2 min read

Most global jurisdictions require that one or more taxes be collected / allocated from a sale.

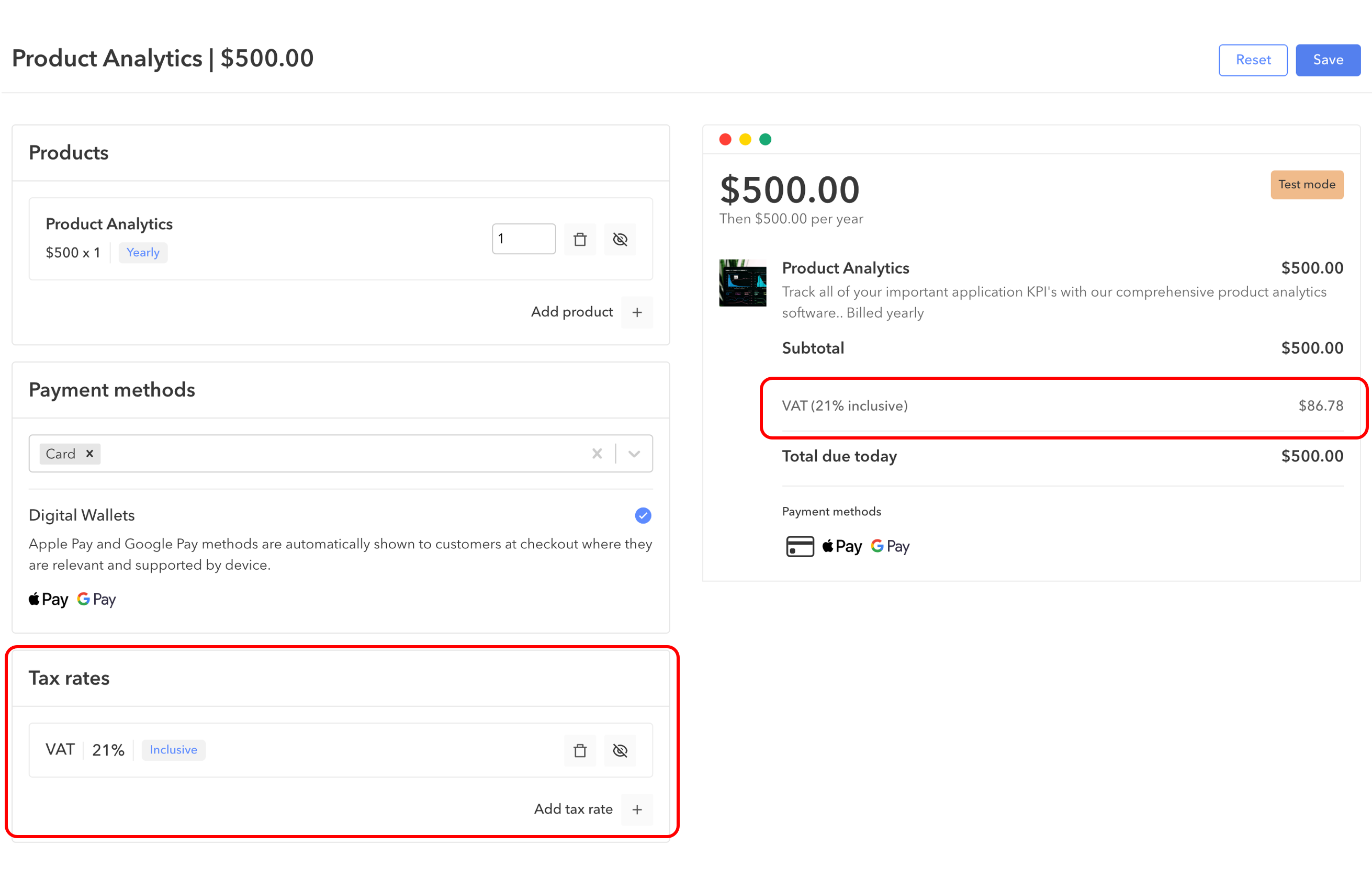

To apply one or more tax rates to sales made through PriceBlocs, you can create and attach them to your payment links via the link builder.

You can see a test example of a payment link with a tax rate applied here.

Attributes

Each tax rate can be given values for

- Percentage rate

- Type - inclusive vs exclusive

- Display name

- Description (optional)

- Jurisdiction (optional)

Inclusive vs Exclusive

Tax rates have two types, they will be either:

- Inclusive - tax is already included in total price

- Exclusive - tax is added on to the total price

Here's an additional breakdown:

Inclusive tax is part of the price. For example, if the price is \$600 and you set an inclusive tax rate of 10%, the invoice total will still be €600. Exclusive tax is applied on top of the price. An exclusive tax rate of 10% on a €600 price will result in an invoice total of €660.

Previous

Resources

Prices

Next

Resources

Coupons